Amortization formula accounting

Law the value of these assets can. In accounting amortizing means spreading out an assets cost over the duration of its lifespan.

How To Calculate Amortization On Patents 10 Steps With Pictures

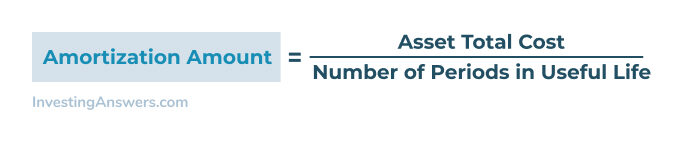

Amortization Expense Assets Cost Assets Useful Life.

. The amortized loan can be calculated by using the following steps. Get Products For Your Accounting Software Needs. Ad Get Complete Accounting Products From QuickBooks.

I 100000 0005 360. R rate of interest. Subtract that from your monthly payment to get your principal payment.

To protect your business and operate under the law you might obtain licenses trademarks patents and other intangible. Firstly the borrower has to determine the loan amount. P initial loan amount or Principal.

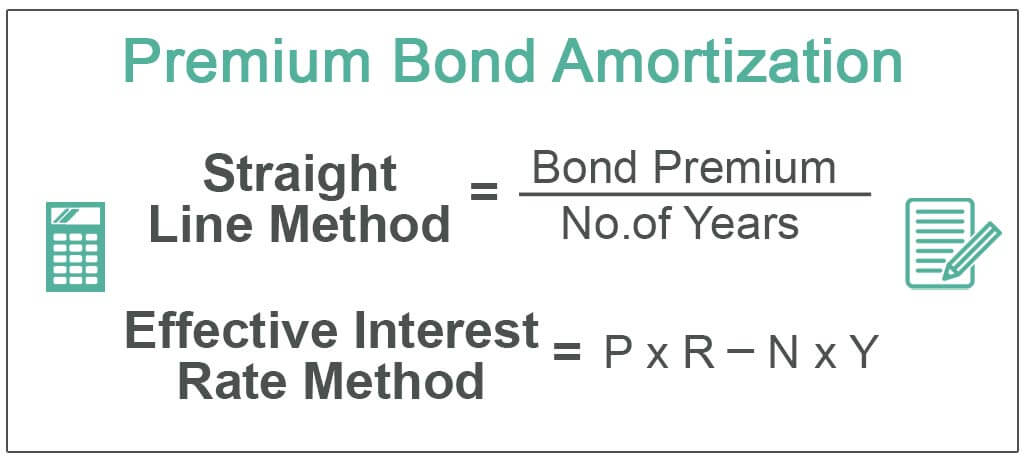

Here we discuss the types formula for calculating straight-line amortization and examples advantages and disadvantages. The amount of amortization accumulated since the asset was acquired appears on the balance sheet as a deduction under the amortized asset. The benefits of recognizing amortization include showing the decrease in the assets book.

Under Section 197 of US. For loans the amortization formula is more complex. This means that the asset shifts.

Essentially amortization describes the process of incrementally expensing the cost of an intangible asset over the course of its useful economic life. Thats your interest payment for your first monthly payment. Formula initial cost à useful life.

This article is a guide to Straight-Line Amortization. 612 0005 per month. The amortization formula under this method is as follows.

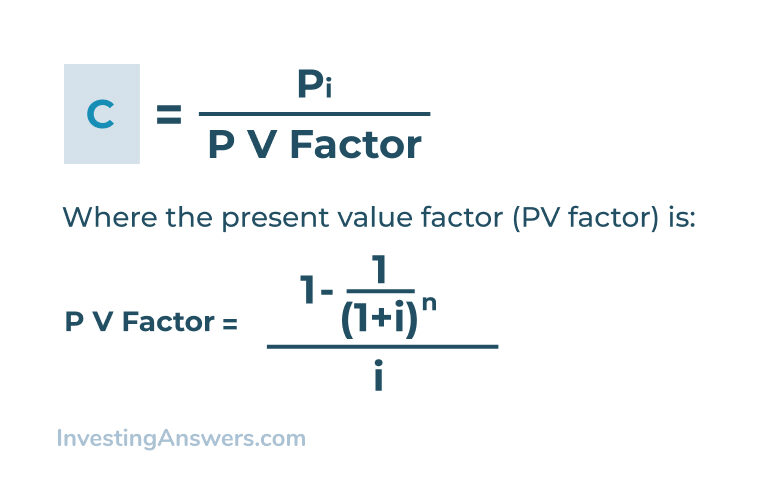

In most cases when a loan is given a series of fixed payments is. Amortization as a way of spreading business costs in accounting generally refers to intangible assets like a patent or copyright. Multiply 150000 by 3512 to get 43750.

If the nominal annual interest rate is i 75 and the interest is compounded semi-annually n 2 and payments are made monthly p 12 then the rate. The borrower citing his capacity and with the availability of loan. The first step is to convert the yearly interest rate into a monthly rate.

Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use which shifts the asset from the balance sheet to the. The next thing to do is to multiply your principal amount with the. In the case of our equipment the company expects a useful life of seven years at which time the equipment will be worth 4500 its residual value.

While there are quite a few factors that need calculation here is the amortization. The amortization of a loan is the process to pay back in full over time the outstanding balance. N total number of payments.

A payment amount.

Amortization Of Bond Premium Step By Step Calculation With Examples

How To Amortize Assets 11 Steps With Pictures Wikihow

Bond Amortization Schedule Effective Interest Method Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

What Is Amortization Bdc Ca

.png)

What Is Amortisation Amortisation Meaning Ig Uk

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Meaning Examples Investinganswers

How To Calculate Amortization On Patents 10 Steps With Pictures

Depreciation Formula Examples With Excel Template

Straight Line Bond Amortization Double Entry Bookkeeping

What Is Amortization Definition Formula Examples

Amortization Using Present Value Theorem Youtube

Amortisation Double Entry Bookkeeping

Amortization Of Intangible Assets Formula And Calculator Excel Template

How To Record Amortization Journal Entries Quora

Amortization Meaning Examples Investinganswers