Figuring profit margin

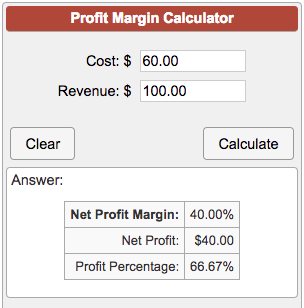

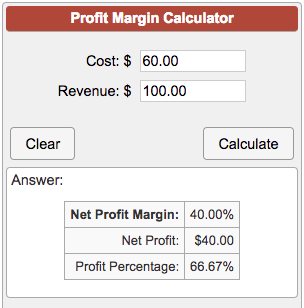

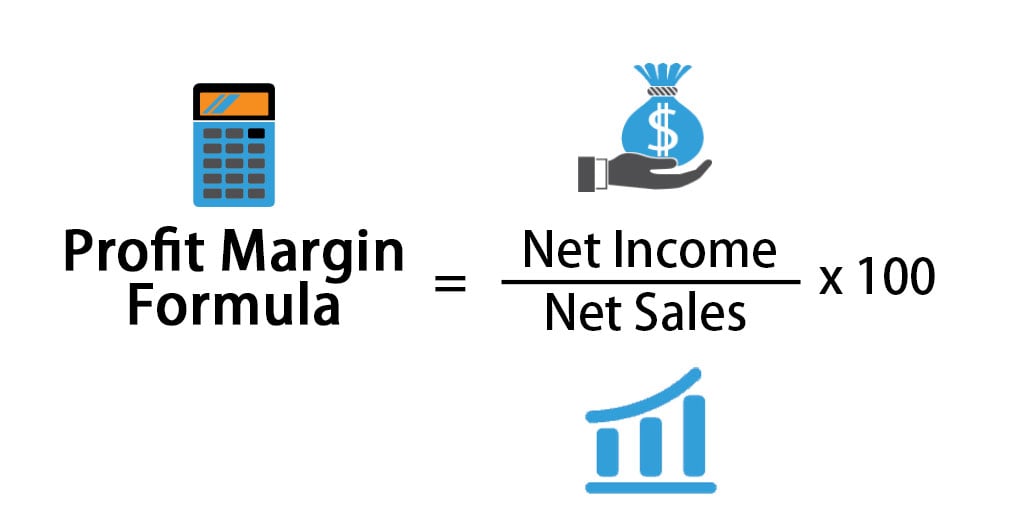

Net Profit margin Net Profit Total revenue x 100. Both gross profit margin and net profit margin can be expressed as a percentage.

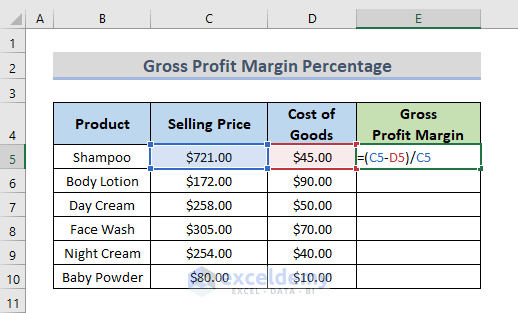

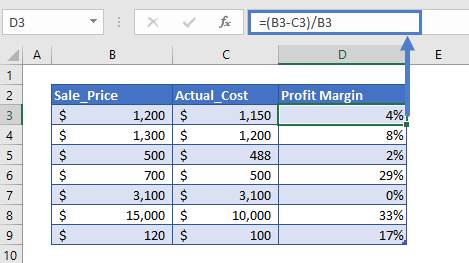

How To Calculate Gross Profit Margin Percentage With Formula In Excel

Easily Approve Automated Matching Suggestions or Make Changes and Additions.

. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. You can calculate all three by dividing the profit revenue minus costs by the revenue. To calculate profit margins companies may need to calculate operational costs total earned revenue and any expenses they are responsible for paying.

Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. To calculate your profit margin you first need to calculate your net income and net sales. A formula for calculating profit margin.

Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors. Rates subject to change. Profit margin ratio example.

Calculating profit margin as a percentage. The gross profit margin is calculated by taking total revenue minus the COGS and dividing the difference by total revenue. Easily Approve Automated Matching Suggestions or Make Changes and Additions.

Profit is your Revenue 100 - Cost 20 - Fees 15 ROI. Lets say you want to figure out the gross profit margin of a fictional firm called Greenwich Golf Supply. Up to 8 cash back Profit margin calculation Profit margin is profit divided by revenue times 100.

Rather than showing a dollar amount for the profit. Net profit margin. Margin rates as low as 283.

Calculating gross profit margin. You do this by multiplying the result by 100. Calculating profit margin determines the percentage amount of profit made in comparison to your sales made or revenue.

The result of the profit margin. The total revenue for that line is. In real terms this means that every 1 of sales resulted in 060 of retained profit.

Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors. Over a decade of business plan writing experience spanning over 400 industries. Calculating gross profit margin is simple when using the profit margin calculator.

Margin rates as low as 283. Work out your own business net profit with this. 30000 50000 x 100 60.

You can find its income statement at the bottom of this page in table. If you want to understand more about how a particular product line is doing calculate the gross profit margin for that line. Rates subject to change.

Recognizing revenues using the. To calculate the net profit margin complete this calculation. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified.

There are three types of profit margins. There is a gross profit margin bigger and a net profit margin smaller. Net profit is calculated by deducting all company expenses from its total revenue.

Company A sells hair care products. Once youve identified your net income and net sales you can use the profit margin. Gross operating and net.

Net profit margin net profit revenue x 100. Here is an example of a profit margin.

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

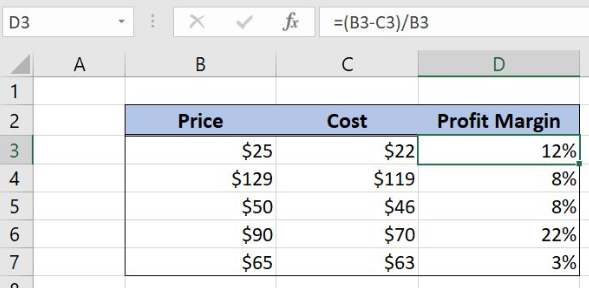

Excel Formula Get Profit Margin Percentage In Excel

Profit Margin Calculator

Net Profit Margin Formula And Ratio Calculator

Gross Profit Margin Formula And Calculator

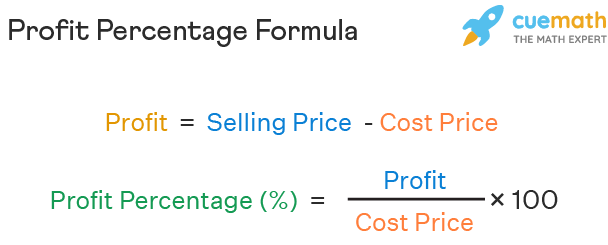

Profit Formula Profit Percentage Formula And Gross Profit Formula

Margin Calculator

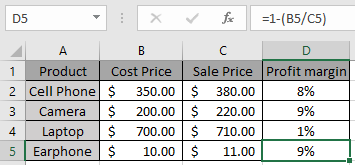

Profit Margin Calculator In Excel Google Sheets Automate Excel

How To Calculate Profit Margin Percentage In Excel

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Profit Formula What Is Profit Formula Examples Method

Profit Percentage Formula Examples With Excel Template

Profit Margin Formula Calculator Examples With Excel Template

Profit Margin Formula And Ratio Calculator

Excel Formula Get Profit Margin Percentage Exceljet

How To Calculate Profit Margin For Your Small Business 3 Steps

How To Calculate Profit Margin For Your Small Business 3 Steps